Advice & Resources for Navigating Changes

- Summary of 2025 Plan Changes for Enrollees

- Customizable Patient Part D Letter

- Pharmacy Part D Flyer/Bag Stuffer

- Pharmacy Part D Bag Clipper

Open Enrollment for 2025 Medicare Part D and Advantage plans starts Oct. 15 and ends Dec. 7. We have news and resources to help you handle the issues you will face. There are major changes in Part D benefits for 2025, and helping your patients early in the process by answering their questions and assisting them with plan comparisons will help them make the best decisions.

American Pharmacies has prepared a customizable letter that you can send to select patients who need help with their plan choices or have questions about whether they should use a preferred or non-preferred network pharmacy. The letter is in Microsoft Word format and can be individualized with your own pharmacy logo, name and address/phone number. We also are providing a Part D bag clipper and a half-page flier that you can print to hand out to patients or use as a bag stuffer. Use the links at the top of this article to download these resources.

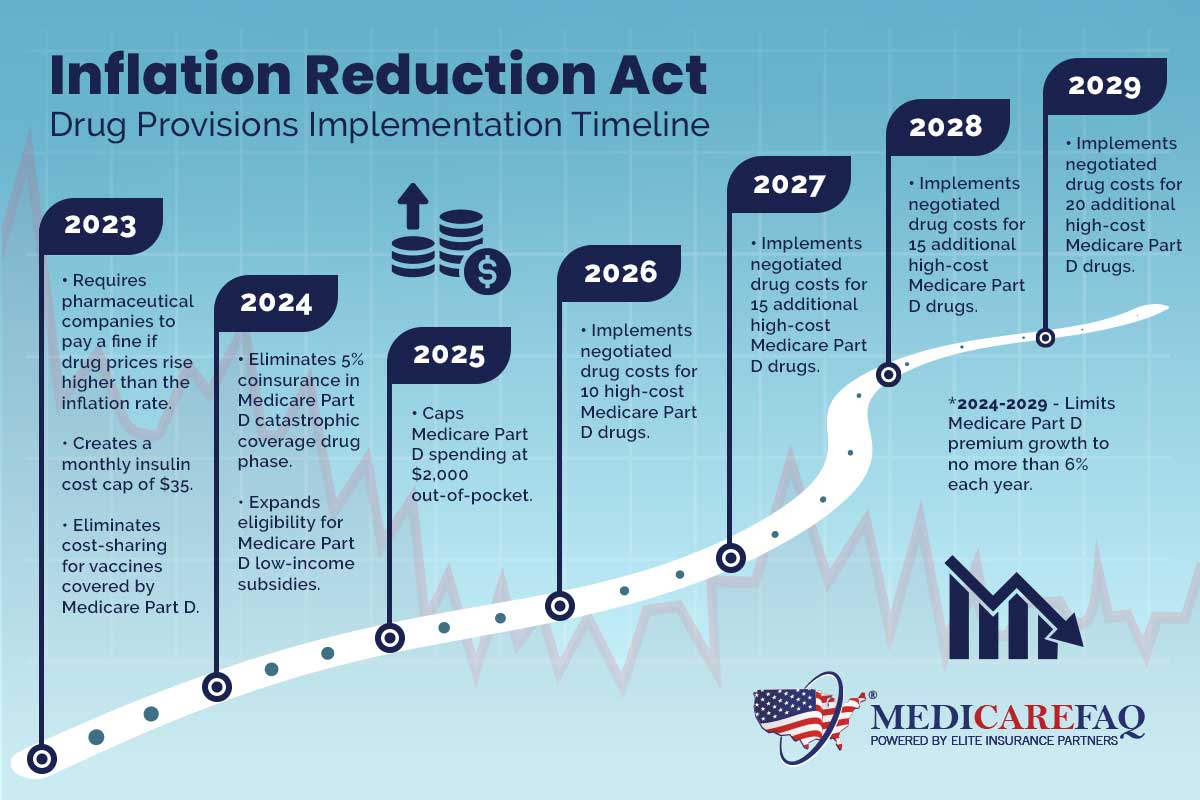

Changes in Part D benefits started in 2023 by the Inflation Reduction Act of 2022 (IRA) continue in 2025, with the biggest changes being the elimination of the coverage gap (donut hole) and the Initial Coverage Limit (ICL).

The annual coverage gap (Donut Hole) is eliminated for 2025. Next year, a Part D enrollee will pay 25% of drug costs after satisfying an initial $590 deductible, with a total $2,000 out-of-pocket limit. Once Medicare Part D enrollees reach their $2,000 out-of-pocket threshold in 2025, they will pay nothing for formulary medications purchased in the catastrophic coverage phase.

The $2,000 annual cap amount – down from $8,000 in 2024 – will be adjusted annually based on inflation in subsequent years.

Part D plans will pick up 60% of a beneficiary’s drug costs in 2025 after they meet the $2,000 out of pocket limit. Drug manufacturers and Medicare will split the remaining 40%. In 2024, Part D plans picked up just 20% of costs in the catastrophic phase, with Medicare paying the remainder.

From 2024-2029, annual Part D premium growth is capped at 6% to ensure that insurers and manufacturers do not pass their new financial responsibilities on to enrollees. Be on the lookout for other ways in which health insurers may try to compensate for their higher costs, such as more prior authorizations, more restrictive formularies and greater restrictions on covered medications and higher co-pays.

New Medicare Prescription Payment Plan

Starting Jan. 1, 2025, Part D plan sponsors must provide enrollees the option to pay out-of-pocket drug costs via monthly payments over the course of the plan year instead of in one sum at the pharmacy.

Part D participants can choose to pay $0 at the counter for covered Part D drugs; plan sponsors will bill those enrollees monthly for any cost sharing that is owed. Pharmacies will be paid in full by the Part D sponsor in accordance with prompt-pay requirements.

- Initial Deductible: Increases by $45 to $590 in 2025. In most cases, beneficiaries pay 100% of drug costs in the deductible phase. After enrollees meet the deductible, they pay 25% of covered costs up to the out-of-pocket limit. Some plans may offer a $0 deductible for lower-cost (Tier 1 and Tier 2) drugs.

- Initial Coverage Limit Eliminated: in 2024, beneficiaries pay 25% of drug costs up to the $5,030 ICL. That $5,030 limit is eliminated for 2025.

- Out-of-Pocket Threshold: Drops from $8,000 in 2024 to $2,000 in 2025 (equivalent to total drug spending of $6,230 in 2025, down from $11,206).

- Minimum Cost-sharing During Catastrophic Coverage: Beneficiaries will pay $4.50 for generic or preferred multisource drugs (or 5%, whichever is higher), up from $4.15. For brand drugs, beneficiaries will pay $12.15 (or 5%, whichever, is higher), up from $11.20 in 2024.

- Maximum Co-payments below the Out-of-Pocket Threshold for certain Low-Income Full Subsidy (LIS) Eligible Enrollees: Increases to $4.90 for a generic or preferred drug that is a multi-source drug and $12.15 for all other drugs in 2025.

As the number of Medicare plans with preferred pharmacy networks continues to grow each year, the number of plans with preferred cost-sharing available at the average retail pharmacy shrinks. In a July 2022 survey of more than 300 pharmacists nationwide, 80% reported that their patients are worried about their preferred pharmacy not being in-network if they choose a different plan.

Actually, it makes NO economic sense to participate as a preferred provider in every Part D plan. The negative margins that you experience as a preferred provider in some Part D plans cannot be overcome through increased script volume.

Cencora’s Elevate Provider Network has proven that profitability is possible in Part D plans through careful plan analysis and by avoiding preferred provider status in plans if it essentially guarantees negative margins. It is important to remember:

- LIS (low-income subsidy) patients pay the same co-pay regardless of whether or not you are a preferred provider. Full-benefit, dual-eligible LIS patients (those on Medicaid) will have a zero co-pay in any Part D plan. And remember that eligibility for full LIS benefits has expanded for 2024, adding 477,000 Americans to this category. If you have a high percentage of Medicaid patients, the impact from not being a preferred pharmacy is greatly minimized.

- Premiums continue to drop for many Part D plans. Also, the new cap on out-of-pocket spending for 2024 means many enrollees are no longer as pinched by costs.

Patient Loyalty Usually Overcomes Plan Cost Differences

That your pharmacy is not preferred with a given Part D plan does not mean your patients need to find another pharmacy or another plan. Patients choose their Part D plan based on many variables:

- Monthly premium;

- Annual deductible;

- Drug coverage;

- Co-pays & cost-sharing;

- Coverage during the donut hole;

- Formulary; and

- The plan’s pharmacy network.

Remember that patients who leave your pharmacy over a small co-pay differential are not likely to be your most profitable patients or the ones purchasing front-end merchandise or other services.

RxCompass Offers Critical Insights Into Plans, Patients

RxCompass, American Pharmacies’ powerful data analytics platform, has strong reporting capabilities that can generate valuable patient and plan insights to improve your plan analyses during Open Enrollment. These custom reports can help you:

RxCompass, American Pharmacies’ powerful data analytics platform, has strong reporting capabilities that can generate valuable patient and plan insights to improve your plan analyses during Open Enrollment. These custom reports can help you:

- Pinpoint your in-network Part D plans and confirm access for existing patients

- Identify newly eligible Part D patients: those reaching age 65 in 2024

- Identify your missing patients: those who filled in one period, but did not return

- Identify patients in specific BIN/PCN/Group combinations

- Evaluate performance by specific BIB/PCN/Group combinations

It may not always be obvious how to best configure these reports to generate the data you need, so American Pharmacies has developed a useful Open Enrollment Utilization Guide that helps you target the data/insights you want and shows how to set up and run the needed reports.

The leading Part D plan comparison tool on the market, EnlivenHealth’s Medicare Match (formerly FDS Amplicare Match) empowers pharmacies to strengthen their patient relationships while expanding revenue growth. Medicare Match helps you efficiently support patients in choosing the Medicare plan that’s the perfect match for their health and finances.

CMS-approved Plan Finder Platform – Enables pharmacies to deliver a successful plan comparison service that increases patient satisfaction and loyalty. The platform includes a convenient formulary look-up tool that suggests drug alternatives that are covered by your patient’s plan.

Win-Win Messaging – Targets patients with plan changes that take them out of network and provides them with plan options and savings opportunities via NavigateMyCare.

Medicare Messaging – Allows your pharmacy to initiate a personalized campaign via mobile app, voice, or SMS text to alert individuals to a Medicare plan opportunity. It provides a convenient link to the Navigate My Care patient plan comparison tool.

NavigateMyCare.com – Provides trusted information and helpful comparison tools tailored to each individual patient to help them explore options and enroll in a plan that’s right for their needs – all from the convenience of your pharmacy.

► Enliven Health Medicare Match Pharmacy Resource Page

► How Medicare Match Can Help You Boost Patient Retention & Revenue

- 10,000 Americans turn 65 each day.

- 47% of seniors say they want help choosing a Medicare Part D Plan.

- 80% of Beneficiaries are not on the most cost-effective Part D plan.

- Medicare plan comparisons help pharmacies mitigate DIR risk by making sure patients are on the best plan for their needs, which can improve adherence.

- 30% are more likely to stay with a pharmacy that performs a plan comparison for them.

To learn more about Medicare Match from EnlivenHealth® visit enlivenhealth.co or call 877-776-2832 to schedule a demo.

- Final CMS Rule on 2024 Medicare Advantage/Part D Plan Canges

- Q1.com Latest News on Annual Medicare Plan Changes

- Q1.com Monthly Newsletter: Keep up-to-date on the latest Part D news & tips

- Medicare Plan Finder: Official resource on medicare.gov

- 2024 Part D Drug Finder: Search for Prescription Drugs Across All Part D or Advantage Plans

- 2024 Medicare Part D Formulary Browser: Search any Medicare plan formulary for drug name, tier, 30-Day and 90-Day cost-sharing.

- Complete Guide to Medicare Open Enrollment: Patient Resource from Medicare Matters

- AARP Medicare Part D Guide: Extensive patient resources; also available in Spanish.